Get the free sd resale certificate form

Show details

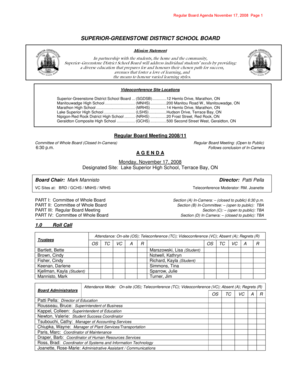

SDE Form 1344 V2 Complete and use the button at the end to print for mailing. Exemption Certificate South Dakota Department of Revenue & Regulation RV-066 Revised 07/03 445 E. Capitol Avenue Pierre,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your sd resale certificate form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sd resale certificate form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sd resale certificate form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sd resale certificate form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out sd resale certificate form

How to fill out sd resale certificate form?

01

Start by obtaining the sd resale certificate form. You can either download it from the relevant state government website or visit a local government office to obtain a physical copy.

02

Read the instructions provided on the form thoroughly before filling it out. This will give you a clear understanding of what information is required and how to complete the form accurately.

03

Begin by providing your personal information in the designated sections. This may include your name, address, phone number, and any other requested details.

04

Next, provide the details of your business, such as the legal name, business type, and any registration numbers or licenses that are relevant.

05

Fill in the section that requires information about your customer for whom the resale certificate is being issued. This would typically include their name, address, and any other necessary details.

06

Specify the reason for issuing the resale certificate. This may include purchasing goods for resale, leasing or renting goods, or using goods as component parts of products intended for sale, among other possibilities.

07

Sign and date the form to validate the information provided. In some cases, you may be required to provide additional supporting documents or declarations with the form. Make sure to include these if requested.

Who needs sd resale certificate form?

01

Businesses that intend to resell goods in the state of South Dakota generally need to have an sd resale certificate form on file.

02

Wholesalers, retailers, and other types of resellers are required to obtain and maintain a valid resale certificate to prove that they are purchasing goods for resale purposes and not for personal use.

03

It is important to note that different states may have different requirements for resale certificates and it is necessary to comply with the specific regulations of the state in which you are operating.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sd resale certificate form?

SD Resale Certificate Form is a document issued by the State of South Dakota to exempt retailers from paying sales tax on goods that will be resold. This form is also known as the South Dakota Sales Tax Exemption Certificate. Retailers can provide this certificate to their suppliers to verify their intention to resell the purchased items and qualify for the sales tax exemption. The SD Resale Certificate Form helps retailers avoid double taxation by allowing them to pass on the responsibility of collecting and remitting sales tax to the end consumer.

Who is required to file sd resale certificate form?

In the United States, the requirement to file a Sales and Use Tax Resale Certificate (sometimes referred to as an "SD Resale Certificate") varies by state. Generally, this form is used by businesses that are purchasing goods for resale. By providing a resale certificate to the seller, the purchaser can avoid paying sales tax on the transaction. However, it's important to note that the exact rules and requirements for filing a resale certificate form can vary significantly between states. Therefore, it is recommended to consult the specific regulations of the state in question.

How to fill out sd resale certificate form?

To properly fill out an SD resale certificate form, you can follow these steps:

1. Obtain the SD resale certificate form: You can usually download this form from your state's Department of Revenue website or request a physical copy from the department directly.

2. Enter your business information: Provide your business name, address, phone number, and any other required contact details in the designated fields.

3. Taxpayer ID: Include your business's sales tax permit or taxpayer identification number. This is generally issued by the state's taxing authority.

4. Description of business: Briefly describe the nature of your business, such as the products or services you provide, in the provided space.

5. Certify your intentions: Indicate that you are applying for this resale certificate for the purpose of making purchases of goods or services that will be resold.

6. Name of supplier: Write the name of the supplier or vendors from whom you intend to purchase goods or services using this resale certificate.

7. Exemption reason: State the reason for the exemption from sales tax. This could be for resale purposes, manufacturing, or other eligible reasons provided by the SD Department of Revenue.

8. Date and signature: Sign and date the form, certifying that the information you provided is true and accurate. It's important to note that the form may require a notary public's signature or witness in some cases.

9. Keep a copy: Make a copy of the completed form for your records before submitting it to the appropriate department or providing it to your supplier.

Always ensure that you follow the specific instructions provided with the SD resale certificate form and refer to the South Dakota Department of Revenue for any additional guidance or requirements.

What is the purpose of sd resale certificate form?

The purpose of an SD resale certificate form (also known as a sales tax exemption certificate) is to enable businesses to purchase goods or services for resale without paying sales tax. The form serves as proof that the purchaser plans to resell the items and therefore can be exempt from paying sales tax on those items. This helps businesses avoid paying sales tax multiple times on the same goods as they move through the supply chain. The form is typically provided to vendors or suppliers when making taxable purchases.

What information must be reported on sd resale certificate form?

The specific information required on an SD resale certificate form may vary depending on the state. However, commonly required information includes:

1. Name and address of the buyer (resale certificate holder).

2. Seller's name and address.

3. Description of items being purchased for resale.

4. Statement that the items will be resold in the regular course of business.

5. State Sales Tax Permit Number (if applicable).

6. Date of issuance.

7. Signature of the buyer or authorized representative.

It is important to consult the specific requirements of the state in question as some may have additional fields or information to include on the resale certificate form.

What is the penalty for the late filing of sd resale certificate form?

The penalty for the late filing of a sales and use tax resale certificate form or SD resale certificate form can vary depending on the jurisdiction and specific regulations in place. In some cases, a late filing penalty may be imposed, typically in the form of a monetary fine or a percentage of the amount owed. It is important to consult the specific rules and guidelines provided by the relevant tax authority to determine the exact penalty for late filing in your jurisdiction.

How do I modify my sd resale certificate form in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your sd resale certificate form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I modify sd resale certificate form without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like sd resale certificate form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an eSignature for the sd resale certificate form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your sd resale certificate form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your sd resale certificate form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.